idaho estate tax return

Last full review of page. Also gifts of 15000 and below do not require any tax payment or estate tax return.

How To File Taxes For Free In 2022 Money

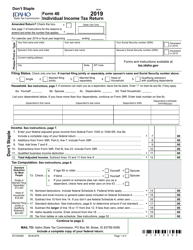

9 of the tax amount reported on Form 40 line 20 or line 42 for eligible Idaho residents and service members using Form 43.

. Page last updated May 21 2019. If you have need assistance with using EFTPS contact EFTPS Tax Payment Customer Service at 800-555-4477 Businesses or 800. The Estate Tax is a tax on your right to transfer property at your death.

The decedent and their estate are separate taxable entities. An estates tax ID number is called an employer identification number or EIN and comes in the format 12-345678X. 1 2005 contact us in the Boise area at 208 334-7660 or toll free at 800 972-7660.

File your Idaho income tax return on or before the 15th day of the fourth month following the close of your tax year. Estates and Taxes Idaho has no gift tax or inheritance tax and its estate tax expired in 2004. 7 rows Idaho might require an Idaho individual income tax return Form 40 or Form 43 for the last.

The Idaho tax filing and tax payment deadline is April 18 2022. Also the Idaho State Tax Commission sets property tax values for operating property which consists mainly of public utilities and railroads. Idaho State Tax Commission issues most refunds within 21 business days.

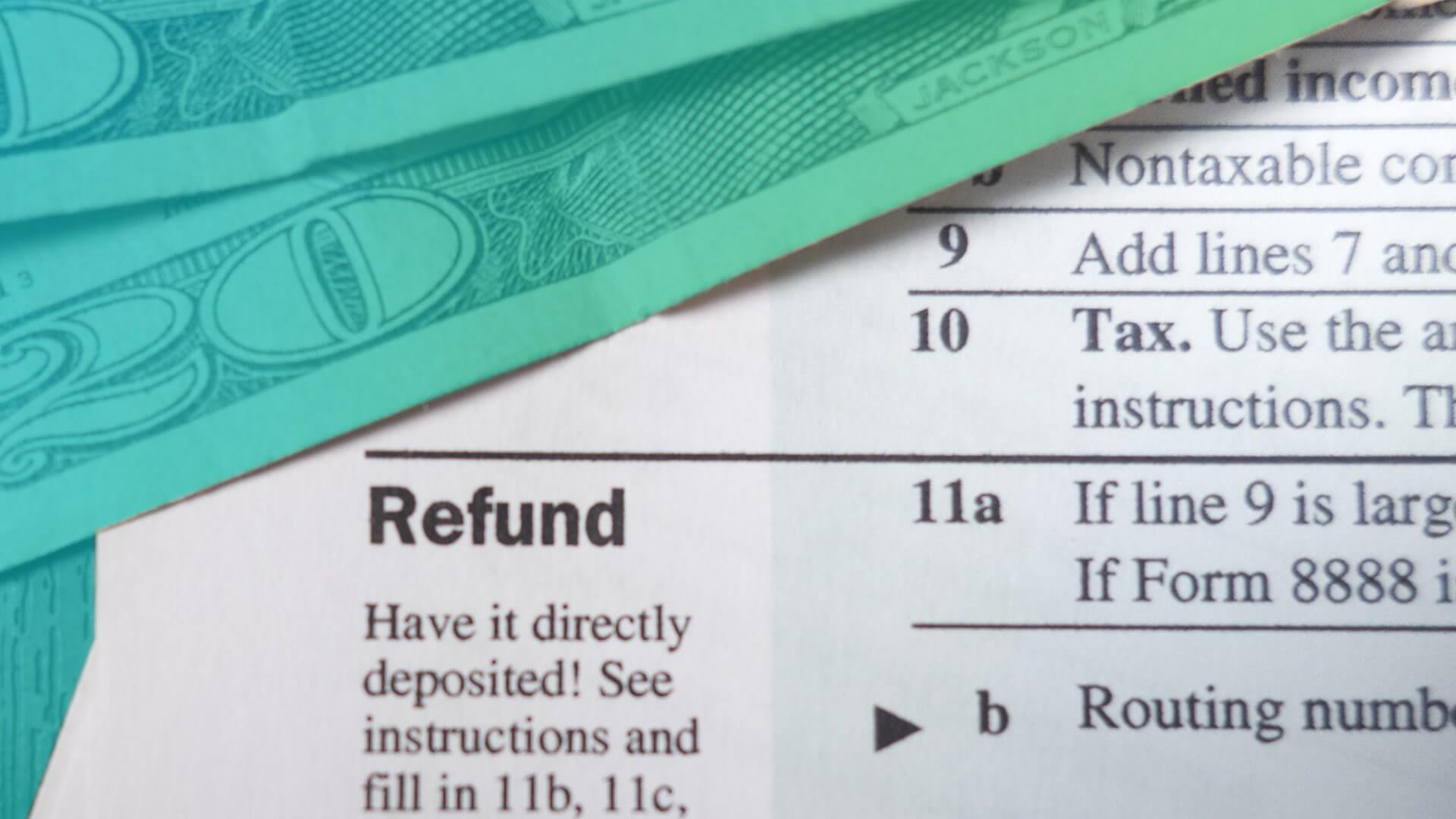

The amount is based on the most recent approved 2019 tax return information on file at the time the rebate is issued. Before filing Form 1041 you will need to obtain a tax ID number for the estate. You can expect your refund about seven to eight weeks after you receive an acknowledgment that we have your return.

Corporate income tax returns. Form 40 is the Idaho income tax return for Idaho residents. Idaho does not impose or assess an estate tax even though the federal government does.

Instructions are in a separate file. Filing Estate and Gift Tax Returns When to File Generally the estate tax return is due nine months after the date of death. An estates tax ID number is called an employer identification number or EIN and comes in the format 12-345678X.

Complete Form ID K-1 for each owner. Corporations partnerships trusts and estates. Thats also the date by which Idaho residents must file their state tax returns.

Its one of the following whichever is greater. Put the amount of Idaho distributable income on line 33 column B. Estate tax also called the death tax applies to estates worth 1158 million or more.

Due the last day of February. You can start checking on the status of your return within 24 hours after they have received your e-filed return or 4 weeks after you mail a paper return. Form 706 estate tax return.

For a calendar year filer this is April 15. You can apply online for this number. State tax commission offices in Coeur dAlene and Lewiston are open on Monday.

You can expect your refund about 10 to 11 weeks after we receive your return. Due the 20 th day of the month following the tax period the tax period may be monthly or quarterly Federal Form 1099 to Tax Commission. Single under age 65.

Start Estate Tax ID EIN Application. So make sure you review your situation with a qualified CPA or tax professional. For example homeowners of owner-occupied property.

Yes Estates are required to obtain a Tax ID. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF PDF. Understand typical refund time frames.

Due April 15 for calendar year filers. Before filing Form 1041 you will need to obtain a tax ID number for the estate. We must manually enter information from paper returns into our database.

You may check the status of your refund on-line at the Idaho State Tax Commission. Married filing separately. Single age 65 or older.

Gross income of 600 or more for the current tax year. If they owe taxes they can go online to our website to pay with our free quick pay service. The amount entered on Form 41S line 40 or Form 65 line 38 of the PTEs return must match the total amount from Form PTE-12 column b.

Taxes are determined according to a propertys current market value minus any exemptions. The deadline to file your federal tax returns has been pushed back to Monday this year. The fair market value of these items is used not necessarily what you paid for them or what their values were when you acquired them.

A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. The decedent and their estate are separate taxable entities. Idaho state income tax rates range from 0 to 65.

If the Tax Cuts and Jobs Act doesnt get renewed the exemption will fall back to its previous level of 549 million which it was in 2017. Note the current tax reform including the 117 million exclusion is only good through 2025. Learn about Idaho tax rates for income property sales tax and more to estimate your 2021 taxes.

Idaho residents must file if their gross income for 2021 is at least. Note that when using EFTPS you will not use the table of codes listed below. This estate tax form files the necessary taxes on the estate death taxes.

Due the 15th day of the 4th month following the close of the fiscal tax year. Estate planning can be complex. If an estate is subject to estate tax someone will need to file Form 706 a federal estate tax return on behalf of the estate.

If the last day for filing a return falls on a Saturday Sunday or legal holiday the return is on time if you file it on the next business day. You may check the status of your refund on-line at the Idaho State Tax Commission. 50 per taxpayer and each dependent.

Form 706 estate tax return In addition to regular income tax a second kind of tax can be levied against certain estates. The goal of this post will be to discuss certain Idaho estate gift and inheritance tax issues to get you up to speed. There is no fee to use EFTPS.

Most homes farms and businesses are subject to property tax. The gift tax return is due on April 15th following the year in which the gift is made. For more details on Idaho estate tax requirements for deaths before Jan.

/u-s-tax-filing-1090495926-21c69e6cc0ba4db0894841c99b26adbf.jpg)

Notice Of Deficiency Definition

New Jersey Tax Forms 2021 Printable State Nj 1040 Form And Nj 1040 Instructions

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Idaho Estate Tax Everything You Need To Know Smartasset

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Form 40 Download Fillable Pdf Or Fill Online Individual Income Tax Return 2019 Idaho Templateroller

Irs Tax Liability Upon Death If Married And Filing Separately

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

Tax Form Templates 5 Free Examples Fill Customize Download

Will The Irs Extend The Tax Deadline In 2022 Marca

Greystone Park Mansion 905 Loma Vista Drive Beverly Hills California Usa Mansions House Design Beverly Hills

Filing An Idaho State Tax Return Things To Know Credit Karma

Here S The Average Irs Tax Refund Amount By State Gobankingrates

Idaho State Tax Return Information Support

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Idaho Estate Tax Everything You Need To Know Smartasset

How To Easily Amend Tax Return Before Irs Catches Your Mistakes Internal Revenue Code Simplified