unemployment tax refund update 2021

This Notice addresses the unemployment compensation exclusion also unemployment exclusion in the federal American Rescue Plan Act and its effect on the taxable income of Michigan resident taxpayers under the Michigan Income Tax Act. People who received unemployment benefits last year and filed tax.

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

10200 Unemployment Tax Free Refund Update How to Check Your Refund Date CA EDD and All States.

. In the case of married individuals filing a joint Form 1040 or 1040-SR this exclusion is up to 10200 per spouse. The tax break is for those who earned less than 150000 in adjusted gross income and for unemployment. Premium federal filing is 100 free with no upgrades for premium taxes.

To qualify for this exclusion your tax year 2020 adjusted gross. The IRS began making adjustments to taxpayers tax returns in May in the first of several phases to correct already filed tax returns to comply with the changes under the American Rescue Plan Act of 2021 ARPA which allows an exclusion of unemployment compensation of up to 10200 for individuals for taxable year 2020. During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes.

Thousands of taxpayers may still be waiting for a. On May 14 the Internal Revenue Service announced they will be correcting and sending out the unemployment tax refund. Hi All Make sure you subscribe and turn on post notifications.

In the latest batch of refunds announced in November however the average was 1189. IRS will send these payments in phases. It excludes up to 10200 of unemployment compensation payments from gross income if the taxpayers modified adjusted gross income is less than 150000.

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer. The 10200 exemption applied to individual taxpayers who earned less than 150000 in modified adjusted gross income. According to the IRS you do not need to file an amended return if you fall into one of these categories.

Millions of people who overpaid taxes on their 2020 unemployment benefits will start getting that money back beginning. The IRS will determine the correct taxable amount of unemployment compensation and tax. Jobless workers who collected benefits the first year of the.

Revenue and MNIT staff have been working through the summer and early fall to update 2020 tax forms to reflect the law changes made in July develop and build a system that is able to adjust over 540000 impacted returns and test that system to ensure the correct refund is issued including additional benefits that may be due because of the. Change language content. The IRS will determine the correct taxable amount of unemployment compensation and tax.

100 free federal filing for everyone. The IRS plans to send another tranche by the end of the year. Another thing the American Rescue Plan did was exempt up to 10200 of unemployment compensation from taxes for the 2020 tax year.

Received jobless benefits last year and paid taxes on that money before the provision in the American Rescue Plan Act of 2021. The American Rescue Plan Act of 2021 authorizes individual taxpayers to exclude up to 10200 of unemployment compensation they received in tax year 2020 only. Phase 1 is for tax.

This Notice is an update to the Notice published April 1 2021 and provides guidance to taxpayers who have. Recovery Rebate Credit. Lets hit 100k subscribers by the end of the year.

Ad File your unemployment tax return free. This Notice addresses the unemployment compensation exclusion also unemployment exclusion in the federal American Rescue Plan Act and its effect on the taxable income of Michigan resident taxpayers under the Michigan Income Tax Act. The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020.

You have an adjustment because of the exclusion that will result in. You already filed a tax return and did not claim the unemployment exclusion. IR-2021-159 July 28 2021.

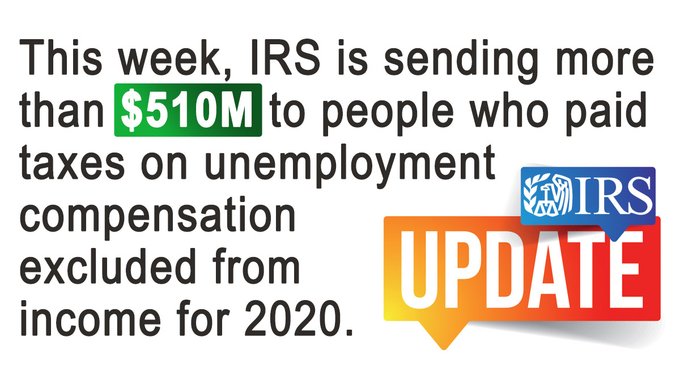

The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. Congress hasnt passed a law offering. The agency had sent more than 117 million refunds worth 144 billion as of Nov.

The update says that to date the IRS has issued more than 117 million of these special refunds totaling 144 billion. Already filed a tax return and did not claim the unemployment exclusion. 22 2022 Published 742 am.

Did not claim the following credits on their tax return but are now eligible when the unemployment exclusion is applied. This video is about the 2021 IRS unemployment tax refund. Since May the IRS has been making adjustments on 2020 tax returns and issuing refunds averaging around 1600 to those who can claim an unemployment tax break.

Last year the government imposed no taxes on those who received up to 10200 of benefits in 2020 as part of the COVID-19 relief law the American Rescue Plan Act. IRS sends out 4 million refunds for 2020 unemployment benefit overpayments. The unemployment tax refund is from the 10200 exclusion from the American Rescue Plan.

According to senior fellow and. The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time. September 13 2021.

Thats the same data the IRS released on November 1 when it. This Notice is an update to the Notice published April 1 2021 and provides guidance to taxpayers. By Anuradha Garg.

I filed as soon as I could at the end of January and I still havent gotten anything from the state the online tool to check says theyre still. The American Rescue Plan Act of 2021 offered relief to people who received unemployment compensation in 2020 at the height of the pandemic when companies were laying off millions of workers. The first 10200 of 2020 jobless benefits 20400 for married couples filing jointly was made nontaxable income by the American Rescue Plan in March.

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year Gobankingrates

How To Receive Your Unemployment Tax Refund As Usa

Unemployment Tax Refund Will You Get A Refund For This Benefit Marca

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

This Annual Tax Reference Guide Is For Any Business That Has Employee S And Contracto Bookkeeping Business Small Business Accounting Small Business Bookkeeping

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Unemployment Tax Break Surprise 581 Checks Paid Out To 524 000 Americans In Time For New Year S Eve Marca

Irs Unemployment Refund Update How To Track And Check Its State As Usa

When Will I Get My Unemployment Tax Refund Hanfincal

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

Unemployment Tax Refund Update What Is Irs Treas 310 Wcnc Com

What To Keep In Mind About Your Unemployment Tax Refunds Wztv

Irs Tax Refunds Who Is Getting Irs Compensation Payments Marca

Irs Refund Status Unemployment Refunds Coming Soon Marca

Unemployement Benefits Are This Payments Taxable Marca

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

Irs Tax Season 2021 Starts Friday From Stimulus Checks To Unemployment Benefits Here S What You Need To Know Federal Income Tax Income Tax Property Tax